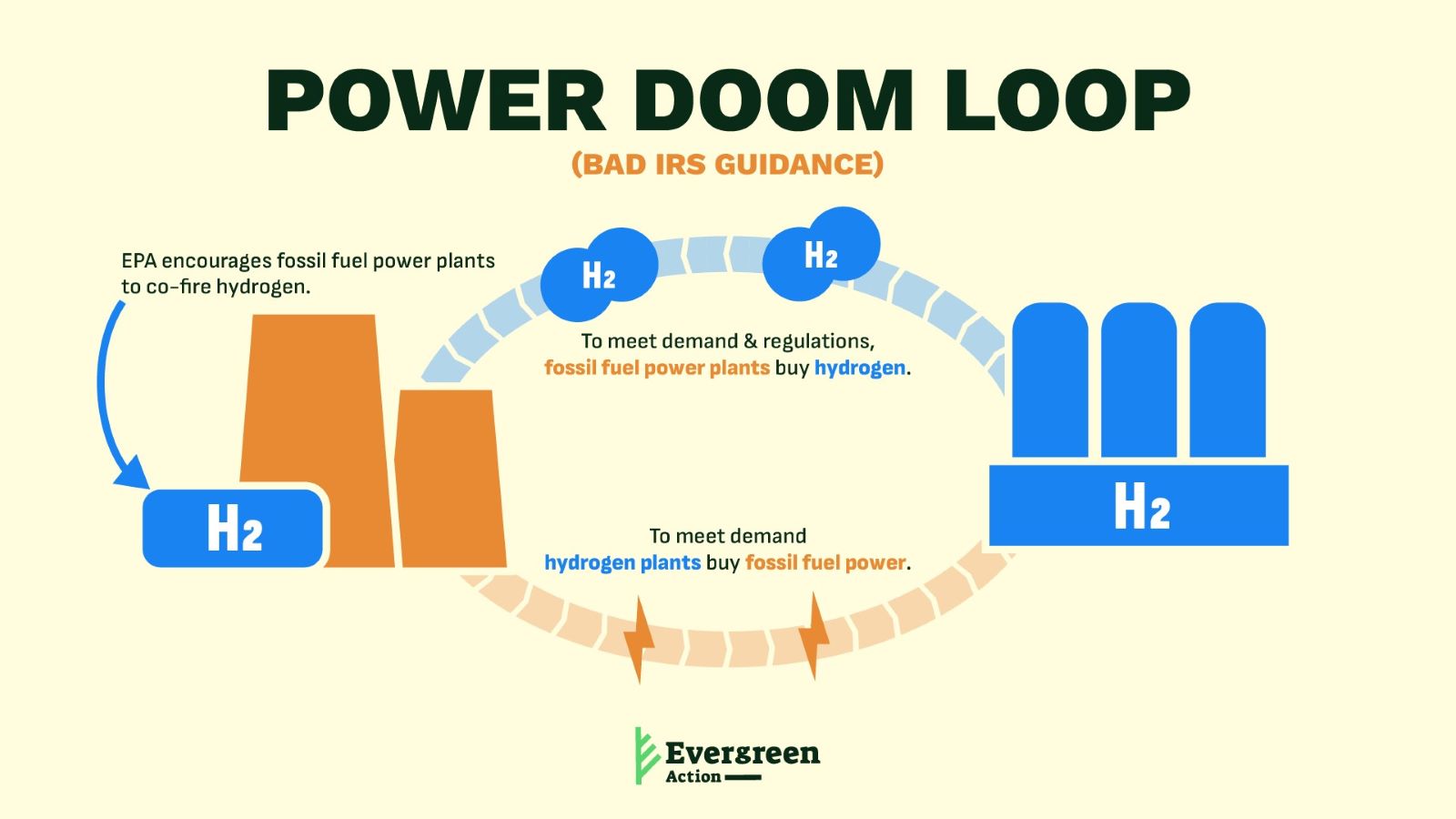

The fate of hundreds of millions of tons of carbon pollution is hidden in a technical IRS decision coming this summer on the Inflation Reduction Act’s (IRA) clean hydrogen tax credit. If IRS folds to industry pressure, it will increase carbon pollution, undermine the future of a truly clean hydrogen industry in the US, and do enormous damage to the Environmental Protection Agency’s (EPA) critical carbon pollution standards before they can even be finalized.

Will death and taxes come for the grid? It’s time for the Biden administration to make sure that IRS does not undercut our race for clean energy. And they need to hear from you. The stakes are high, and polluters would prefer the public get lost in the details. Instead, let’s take a look at the pollution hidden in the fine print—and why it’s not too late to stop it.

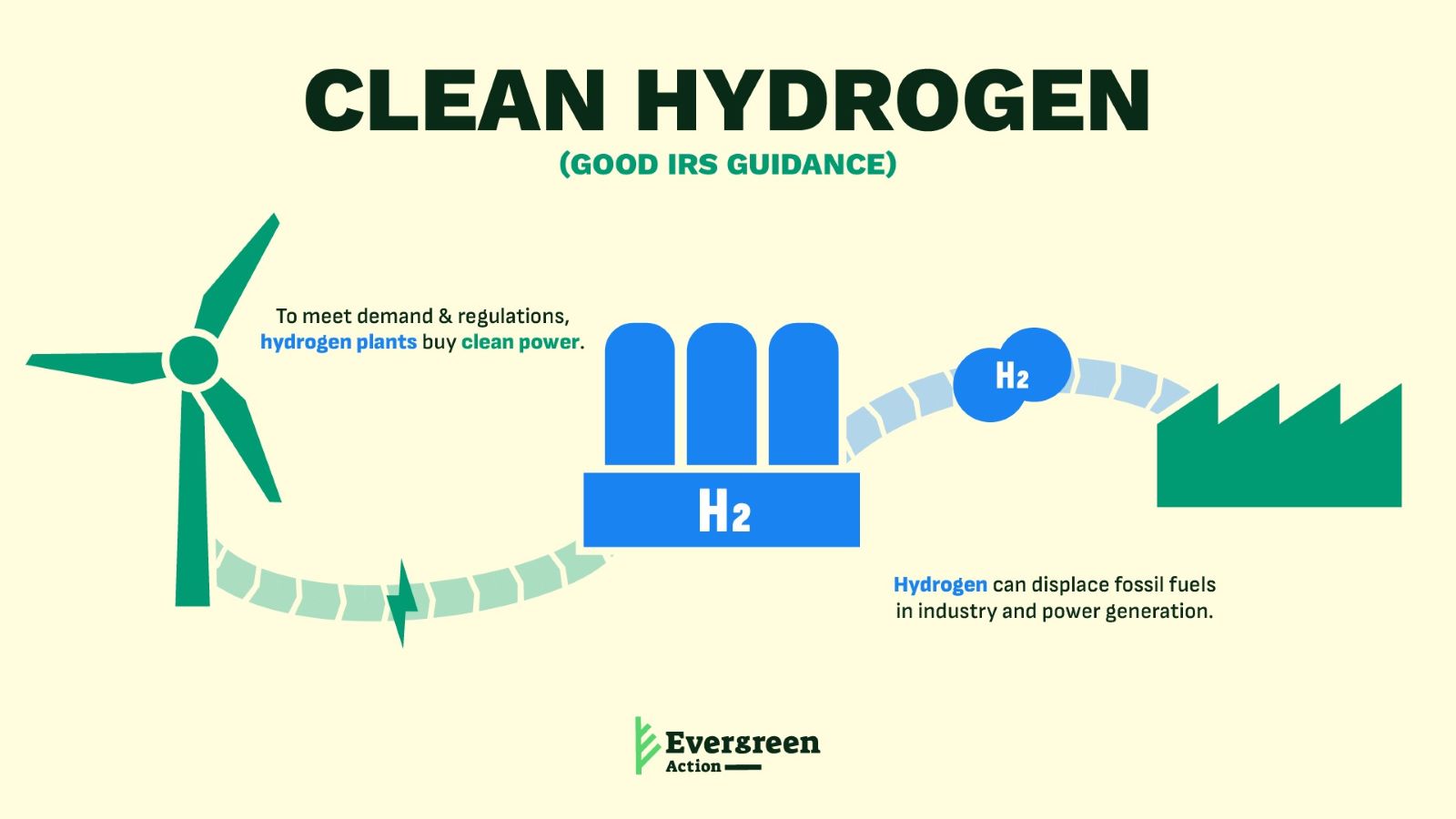

What is clean hydrogen?

As leading advocates from NRDC and Energy Innovation have been pointing out for months, at stake is a lucrative and uncapped tax credit from the Inflation Reduction Act for producing clean hydrogen. Hydrogen is a potent fuel that can be burned without greenhouse gas emissions—and therefore could be used to cut carbon pollution from sources that burn fuel if it is also produced without increasing emissions. However right now, most hydrogen is produced through a dirty refinery process using fossil fuel-heated steam to break apart molecules of fossil gas—a process known as “steam methane reforming.” We don’t need more of that.